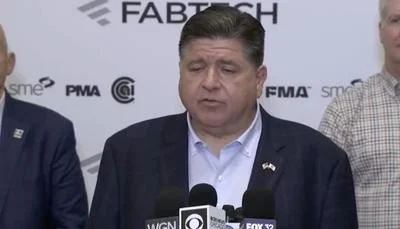

Ted Dabrowski, president of the website Wirepoints, says Gov. J.B. Pritzker's first act as governor of Illinois confirms what Wirepoints predicted before he took office: He will not keep promises he made while campaigning.

Pritzker granted pay raises to AFSCME (American Federation of State, County and Municipal Employees) workers that Wirepoints claims will cost Illinois as much as $200 million a year, according to a press release. Pritzker also went forward with back pay that former Gov. Bruce Rauner had blocked, which will add $400 to $500 million in costs onto the backs of taxpayers, according to Dabrowski.

Dabrowski said in a press release that the state is already running a $1.2 billion deficit and that Illinois state workers are already the second-highest paid in the nation with great healthcare benefits, free retiree health insurance and the equivalent of $1.8 million in lifetime pensions during their retirement for each employee who spent more than 30 years working for the state—on top of Social Security benefits.

"And never mind that Illinois residents are tapped out due to the recent 32 percent income tax hike, the nation’s highest property taxes and the partial loss of state and local tax deductions at the federal level," the release states.

Pritzker made several promises while campaigning, including balancing the state's budget and easing the tax burden for the middle class without touching pensions or healthcare for retirees, which Wirepoints said is impossible.

Dabrowski wrote in the release that Pritzker's plans to put a progressive income tax on the wealthy or use marijuana and gambling taxes would not be enough to ease the burden.

"The reality is Pritzker can only get all the revenues he wants by hitting middle-income Illinoisans hard," Dabrowski wrote in the press release. "To achieve his minimum spending targets, Wirepoints found that the middle class with incomes of $50,000 and above would have to be hit with higher taxes."

According to estimated 2018 progressive income tax revenues based on the data from the 2015 tax year, anyone making up to $50,000 would pay a 4.95 percent tax rate upward to those making more than $1 million paying an 11.2 percent tax rate.

Wirepoints claims Pritzker is promising the exact same government that Illinois already has and has had for decades.

"The governor would do far better to focus on the real 'hard choices,' like enacting the structural reforms Illinois so desperately needs—including a constitutional amendment for pensions," the release states. "That would serve all Illinoisans far better than impossible tax and spend promises."

Alerts Sign-up

Alerts Sign-up