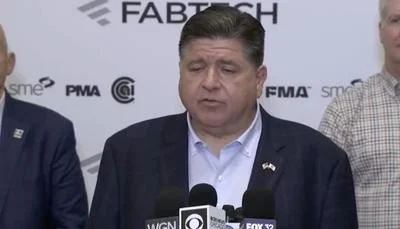

Illinois Governor J.B. Pritzker issued the following announcement on Jan. 23.

Governor JB Pritzker joined Illinois Treasurer Michael Frerichs to announce a $100 million program to fund zero or low-interest loans so furloughed federal workers who live in Illinois can pay their bills during the partial federal government shutdown.

In addition, the Governor called on lenders doing business in the State of Illinois to waive fees and provide other support to furloughed workers, especially as they deal with mortgage payments, student loans and car loans. Lenders that have already agreed to participate are listed online at www.illinois.gov/shutdownaid; their assistance ranges from deferments on loans to 0 percent interest to assisting individuals on a case-by-case basis.

The Illinois Department of Commerce and Economic Opportunity (DCEO) is also offering winter heating assistance to qualified federal workers through the Low Income Home Energy Assistance Program (LIHEAP). Federal workers whose last 30 day income has been impacted by the federal shutdown can find a complete listing of LIHEAP's local administering agencies and additional information about the program here, or call the LIHEAP toll-free hotline at 1 877 411-WARM (9276).

More than 8,000 federal employees who live in Illinois have been affected by the partial shutdown that began Dec. 22. Nationally, the figure is more than 800,000.

"Through no fault of their own, federal employees living in Illinois are not receiving their paychecks while expenses continue to pile up," said Governor JB Pritzker. "We have an obligation as a state to do everything we can to help those paying a direct price for the actions of the president. This loan program will help those struggling to meet their day-to-day expenses as the shutdown drags on. My administration is continuing to explore all possible options to shore up critical services that receive federal funding, to make sure our most vulnerable families are protected from the harm the Trump shutdown might cause, and to assist impacted federal employees."

The "linked" deposit loan program will be run by the Treasurer's office in partnership with various banks and credit unions across the state. The Treasurer's office will make deposits in participating financial institutions, allowing these institutions to provide below-market rates to federal workers who qualify for the program. For example, the state might offer a deposit at 0.01 percent if the financial institution agrees to loan out the money to federal works at 0.0 percent. Specific rates and terms of eligibility will vary by institution.

"This program will help bring relief for working families impacted by this impasse," said Treasurer Michael Frerichs. "The President shut down the federal government and threatened the livelihood of thousands of families in Illinois to play political games. Difficult policy debates are a hallmark of government, but we cannot let our disagreements hurt working families who want nothing more than to pay their bills, raise a family, and save for the future."

"The Illinois Bankers Association's 300 member banks stand with Governor Pritzker in his call to assist workers who are struggling with the federal government shutdown," said Linda Koch, President & CEO, Illinois Bankers Association. "We are proud that banks throughout Illinois are offering help to federal employees and other businesses and individuals affected by the shutdown."

"On behalf of the IBA Board of Directors, I thank Governor Pritzker for his leadership and call to action on this serious matter," said Daniel P. Daly, Illinois Bankers Association Chairman and President & CEO, SENB Bank, Moline. "Illinois' banking community takes pride in serving the needs of our customers, and certainly those individuals and businesses impacted by the shutdown are no exception. Our bank, and all Illinois banks, stand ready to help our customers through this hardship."

"Based on the makeup of the membership, we have a number of the 270 credit unions in Illinois with a significant percentage of federal workers as members," said Tom Kane, President Illinois Credit Union League. "Many of these credit unions have implemented formal programs to assist federal workers with special low or no interest payroll interruption loans, skip-a-payment options, or waiving penalties for cashing in a CD early. In addition, I would urge any furloughed federal employee who is a member of a credit union to stop into a branch and ask what they can do to help during this challenging time."

A partial list of participating banks and credit unions offering assistance are below:

• 1st Mid America

• Bank of America

• BMO Harris

• CIBC

• Citizens Equity First Credit Union (CEFCU)

• Community Plus Federal Credit Union

• First Midwest Bank

• Heartland Credit Union

• Home State Bank

• IH Mississippi Credit Union (IHMVCU)

• KCT Credit Union

• R.I.A. Federal Credit Union

• Scott Credit Union

• JP Morgan Chase

• SENB Bank

• SIU Credit Union

• University of Illinois Community Credit Union

• U.S. Bank

• U.S. Employee Credit Union

• Wells Fargo

• Wintrust

• Vibrant Credit Union

A full list services being provided by participating banks can be found here and participating credit unions can be found here. For more information on aid for federal workers during the shutdown visit the governor's website at www.illinois.gov/shutdownaid. The site will be updated periodically with additional information.

Original source can be found here.

Alerts Sign-up

Alerts Sign-up