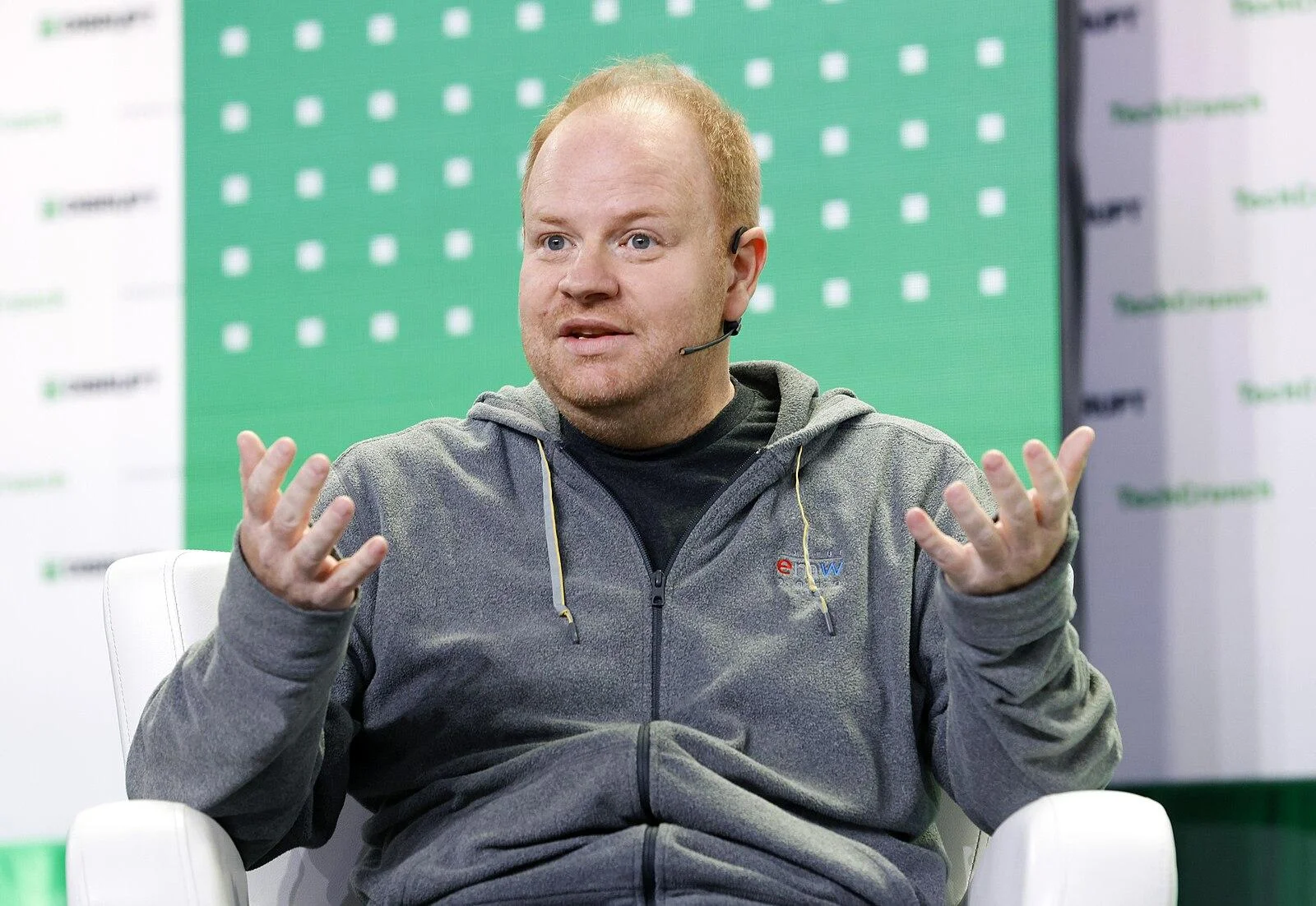

Parker Conrad | Wikimedia Commons / TechCrunch

Parker Conrad | Wikimedia Commons / TechCrunch

A fast-growing HR and insurance technology firm now known as Rippling Insurance Services may have made false or misleading statements in official filings with the Illinois Department of Insurance, documents reviewed by Prairie State Wire show.

Despite multiple documented discrepancies across state filings, Rippling, which was known as Waveling Insurance Services until 2019, did not respond to requests for comment from Prairie State Wire seeking an explanation for the inconsistencies and clarifying the current role of founder Parker Conrad in the organization.

Despite acknowledging in Tennessee that its founder, Conrad, had been fined and had surrendered his insurance license in other states, Rippling failed to disclose those facts in license applications submitted to Illinois regulators in both 2017 and 2019.

Rippling sign.

| Facebook / Rippling

Conrad resigned as CEO of Zenefits in February 2016 amid the company's widespread licensing violations, which included allowing unlicensed employees to sell insurance in multiple states.

Regulatory investigations revealed serious compliance failures under Conrad’s leadership, prompting threats of shutdowns and legal action from several state insurance commissioners.

In 2018, Conrad surrendered his California insurance license and was fined $35,000 by the Texas Department of Insurance for his role in the violations.

Conrad’s successor at Zenefits, David Sacks, acknowledged the company’s failures.

“Many of our internal processes, controls, and actions around compliance have been inadequate, and some decisions have just been plain wrong. As a result, Parker [Conrad] has resigned,” Sacks said, according to statements quoted in a lawsuit filed by competitor Deel, Inc. in Delaware Superior Court.

Yet in Illinois, that regulatory history appears to have been omitted.

In a November 2017 non-resident insurance license application filed with Illinois, Waveling responded “No” to a question asking whether any company leader had ever had a license suspended, revoked, or surrendered, or been fined.

The company gave the same response in a license renewal application filed in April 2019.

However, just one month after the 2017 Illinois filing, the company answered “Yes” to the same question in its December 2017 Tennessee application, where it acknowledged that Conrad had been involved in administrative actions.

In a supplemental letter sent to Tennessee regulators, company executive Thomas Grady explained that Conrad had entered into a regulatory settlement in Texas due to actions at Zenefits.

Grady told Tennessee regulators that Conrad was not a “control person” in Waveling, claiming instead that Conrad was a “non-controlling shareholder” in the parent company.

But a December 2017 California application filed by Waveling lists Conrad as a “controlling person” who owned 60% of the company.

Then-California Insurance Commissioner Dave Jones said in a May 2018 press release that Conrad was “ultimately responsible” for the Zenefits violations, in which employees used software to circumvent licensing requirements.

The California settlement required Conrad to surrender his license, pay $66,000 and agree not to transact insurance in any capacity without first obtaining a license.

State records show that Waveling's Illinois license first became active in Illinois in November 2017.

In December 2019, the company updated its name with the Illinois Department of Insurance, becoming Rippling Insurance Services.

At the time of that 2019 name change and re-licensing process, Matt Plank, then Chief Revenue Officer at Rippling, submitted updated licensing paperwork.

On the application, Plank answered “No” to a question asking: “Has the business entity or any owner, partner, officer or director of the business entity, or manager or member of a limited liability company, ever been named or involved as a party in an administrative proceeding, including a FINRA sanction or arbitration proceeding regarding any professional or occupational license, or registration?”

Rippling’s Illinois insurance license is currently set to expire on May 31, 2027, according to state records.

Deel’s lawsuit, filed against People Center, Inc. (doing business as Rippling) and unnamed defendants, accuses Conrad of repeating past behavior.

“Rippling and Conrad have fallen back on his old playbook: cheating,” Deel’s lawsuit reads.

The lawsuit includes claims that whistleblowers reported Rippling was misappropriating client payroll tax and social benefit funds by classifying them as company earnings.

“Just one example of Rippling’s casual yet appalling lawlessness, on information and belief, whistleblowers have expressed concern that Rippling was not remitting its customers’ payroll tax and social benefits dollars to local taxation authorities as required, but instead was categorizing and reporting these funds as its own earnings,” Deel said in its lawsuit. “On information and belief, not only does Rippling steal these funds from its clients, but also from its own employees by using a similar scheme.”

While the lawsuit brought by Deel remains ongoing and the claims are unproven, the allegations, coupled with Rippling’s conflicting statements in regulatory filings, raise questions about transparency and regulatory oversight.

Alerts Sign-up

Alerts Sign-up