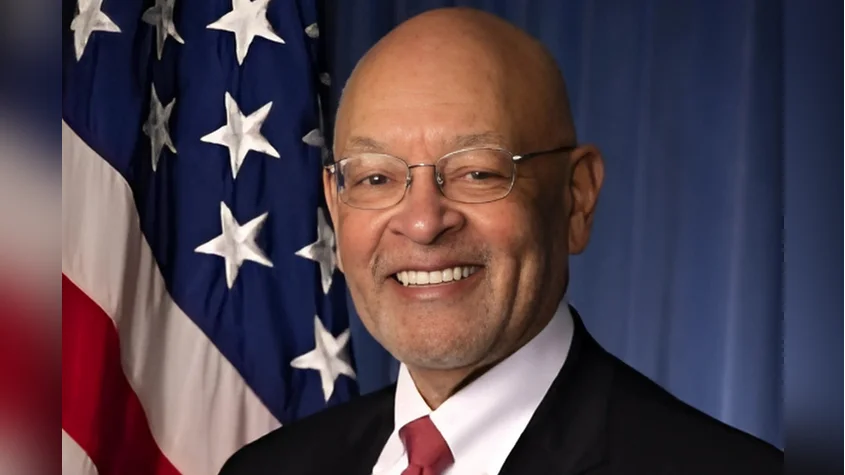

Gregory K. Harris, U.S. Attorney | U.S. Attorney's Office for the Central District of Illinois

Gregory K. Harris, U.S. Attorney | U.S. Attorney's Office for the Central District of Illinois

A federal jury has found Jalal Nimer Asad, 61, of Lindenhurst, Illinois, guilty on twenty-one felony counts related to conspiracies involving tax fraud and financial structuring. The verdict was delivered at approximately 9:00 pm on September 10, 2025. Asad's sentencing is scheduled for January 8, 2026, at the U.S. Courthouse in Peoria.

According to evidence presented during the seven-day trial, Asad led a group that owned and operated several convenience and liquor stores in the Central District of Illinois. Prosecutors demonstrated that Asad and his associates maintained two sets of financial records—one accurate and one falsified—to underreport earnings and reduce their state and federal tax liabilities. The government also established that Asad structured financial transactions to withdraw over $4 million in cash without triggering mandatory bank reporting requirements.

The original indictments against Asad and his co-defendants were returned by a federal grand jury in 2009. While other defendants either pleaded guilty or were convicted more than fifteen years ago, Asad remained a fugitive overseas until recently returning to the United States.

Asad was convicted of conspiracy to defraud the United States, six counts of tax evasion, nine counts of mail fraud, conspiracy to structure financial transactions, and four counts of structuring financial transactions to avoid reporting requirements. He faces up to twenty years in prison.

The investigation involved the Internal Revenue Service and the Federal Bureau of Investigation’s Springfield Field Office, with support from local law enforcement including the Decatur Police Department. Supervisory Assistant United States Attorney Eugene L. Miller and Assistant United States Attorney Douglas F. McMeyer prosecuted the case.

"

Alerts Sign-up

Alerts Sign-up