While debate continues on how Illinois state school funding should be distributed, Rep. Jeanne Ives (R-Wheaton) is arguing that the system will never be fair until county property tax assessments are conducted on the mandated schedule, according to a press release.

“If we are going to fix the school funding formula, it is imperative that we also fix the assessment system upon which the school funding formula depends,” Ives said. “School funding across the state will continue to be inequitable and unfair until we deal with this issue.”

Illinois school funding is based on numerous factors, but the primary consideration is how much that district is able to raise on its own through property taxes. The more property wealth a district has access to, the less funding it will receive from Springfield. Ideally, poorer districts receive enough funding to offset their lack of tax revenue.

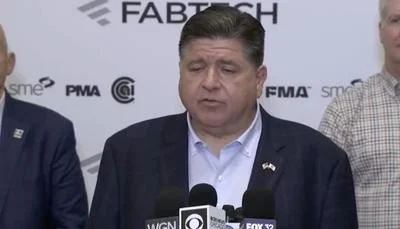

Rep. Jeanne Ives (R-Wheaton)

But according to Ives, property tax assessments, which are used to determine the value of homes in a jurisdiction, are not being conducted as often as required, allowing some government entities to artificially deflate their property wealth, Ives contends.

Ives wants the Illinois Department of Revenue to investigate each county in the state and establish its compliance with assessment laws. She said she was spurred to action following comments from a Perry County administrator about school funding reform. Over the course of his testimony in the House, Du Quoin Community Unit School District 300 Superintendent Gary Kelly told lawmakers that his district had not seen new assessments in decades.

“It was shocking to hear a veteran school superintendent (Kelly started at Du Quoin in 1993) so casually suggest that his county is willfully ignoring state law,” Ives said. “Property reassessments must be done by law a minimum of every four years. The law is clear.”

Ives found that Perry County hasn’t done a reassessment since 1982 and many counties do random reassessments on subjective selections of properties. In downstate and suburban areas, Ives contends, this can lead to property owners drastically overpaying on their tax bills to prop up their local school districts.

According to Ives' press release, Coles County business owners recently filed a federal lawsuit against the county, claiming that it is willfully refusing to reassess properties that have devalued in order to maintain higher tax revenues. A Chicago City Wire report showed a similar overvaluation in the city’s West Pullman neighborhood, where 10 consecutive home sales averaged 75 percent less than their assessed value.

“Illinois has the highest effective property tax rates in the nation," Ives said in the release. "We just raised income taxes 32 percent when too many of our residents already cannot afford to live here. We need a system where residents can be assured that they will not be taxed out of their homes over time.”

On the other hand, not conducting reassessments can also benefit certain property owners and jurisdictions, which can give out lower tax bills and make up some of that lost revenue through state funding. Ives pointed to Chicago, where some commercial sales of properties topped $1 billion and revealed that the buildings were under-assessed by up to 60 percent.

“The system we use to value real estate and establish property tax bills in this state is corrupt and broken," Ives said in the release. "The evidence is overwhelming: it purposely mis-values your home. It needs to be fixed.”

Alerts Sign-up

Alerts Sign-up