Eight years after lawmakers approved the first of two large state income tax hikes, a new analysis shows Illinois' net position deficit quadrupled to $189.1 billion in 2018 from $43.6 billion in 2011.

The numbers were released in the Illinois Comprehensive Annual Financial Report (CAFR) in late August. A state government's net position is similar to an individual's net worth.

According to the report, the state's financial health worsened in the year following Illinois' record-breaking income tax hike in 2017. The CAFR's new numbers have been restated to calculate the true cost of state employee health care liabilities for the first time. The original net position deficit reported by the previous CAFR in 2017 was $141.7 billion. This means that in a single year, Illinois' net worth dropped 35 percent, or $47.4 billion, despite enacting the sharpest permanent income tax increase in state history.

Among the 50 states and the District of Columbia, only New Jersey is positioned lower than Illinois in terms of deficit-level net worth. The Garden State's net position in 2018 was nearly $200 billion, according to numbers from the Illinois Auditor General.

Fourteen of the 50 states and D.C. carry negative net worth. New Hampshire, Vermont, Rhode Island and Michigan showed the greatest net positions among the deficit-riddled states; all report red ink near the $1 billion mark. Other states, like Louisiana and Maine, show a neutral $0 position. In contrast, Alaska, Florida and North Carolina report the highest of surpluses with an estimated $70 billion, $62 billion and $44 billion, respectively.

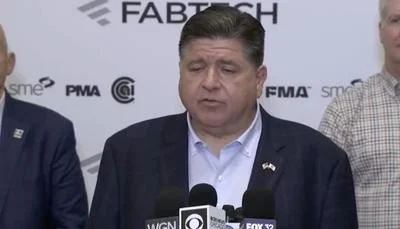

Opponents assailed Gov. J.B. Pritzker's progressive income tax proposal in 2016 as the "blank check" amendment.

Alerts Sign-up

Alerts Sign-up