A recent non-partisan Tax Foundation report revealed that Illinois residents face some of the highest taxes in the country and the state is ranked the fifth worst state for local and state taxes.

“Last year, Springfield Democrats shoved a $5 billion state income tax increase down the throats of Illinois taxpayers,” Jim Tobin, president of Taxpayers United of America (TUA), said in a statement. “Now, the Democrat candidate for Illinois Governor, J. B. Pritzker, should he win, will clobber the Illinois middle class with another huge increase in the state income tax. This will be the payback for the votes he will get from the 107,000 retired government employees who receive over $50,000 a year in retirement benefits for doing nothing.”

Illinois’ tax system is ranked lower than California’s with the West Coast state coming in one spot below Illinois at number six, according to the report.

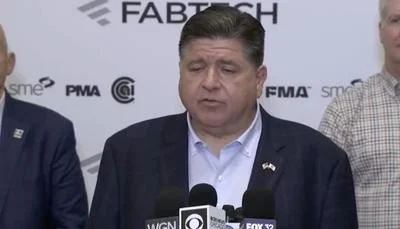

Jim Tobin

“In two years, Pritzker will push approval of the Income Tax Increase Amendment, which would convert Illinois’ flat-rate state income tax to a graduated income tax, with a top rate possibly higher than California’s,” Tobin said. “The money from last year’s $5 billion income tax increase was funneled into the bankrupt state pension funds for retired government employees, but the funds are in such bad shape that the money hardly mattered. These leeches are getting lavish, gold-plated retirement benefits while the middle class is fleeing Illinois in increasing numbers. For four straight years, Illinois has led the nation in population outflow, and this will increase if Pritzker has his way.”

Illinois residents have faced increasing taxes for several years and the state is dealing with massive shortfalls, Tobin said.

Pritzker has promoted a progressive income tax but some question if the plan would be enough to solve the state's money problems.

Residents have been moving out of Illinois in large numbers and a recent poll found that many are considering leaving the states because of high taxes, according to the Illinois Policy Institute.

“Pritzker’s proposed two state income tax increases will put Illinois into a death spiral," Tobin said. "That will be the end of our state, unless voters wake up and elect persons who will vote against additional tax increases.”

The Tax Foundation is a Washington, D.C.-based, non-partisan think tank.

Alerts Sign-up

Alerts Sign-up