Ways to tax fuel include sales taxes, per-gallon excise taxes and taxes imposed on wholesalers, according to the Tax Foundation. | Pexels.com / Engin Akyurt

Ways to tax fuel include sales taxes, per-gallon excise taxes and taxes imposed on wholesalers, according to the Tax Foundation. | Pexels.com / Engin Akyurt

Illinois residents pay 67 cents in state taxes per gallon on the gasoline they purchase, the second highest level among the 50 states, according to a new analysis by the Tax Foundation.

Illinois’ gas taxes include more than 45 cents in state excise tax and 21 cents in other state taxes and fees, according to the report. Those state taxes are on top of a federal gas tax of 18.3 cents per gallon. The data reflects the rates that were in effect as of July 1.

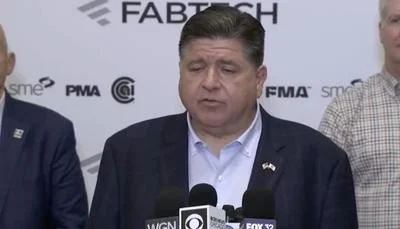

In Illinois, the gas tax had been only 19 cents per gallon before Gov. J.B. Pritzker and the state Legislature moved to raise it to 38 cents per gallon in 2019 and to index the tax annually with the rate of inflation, according to the Illinois Policy Institute.

The Prairie State had been scheduled to see gas taxes rise by 3.1 cents last month, but state officials delayed the increase by six months, meaning Illinois drivers will face two gas tax hikes in 2024, the institute reported. A gas station trade group is also fighting a requirement that it promote the delayed gas tax, contending that would be a violation of free speech.

States have seen an erosion of their gas tax revenues over time due to the development of more fuel-efficient vehicles and electric cars, according to the Tax Foundation. Generally, gas tax revenues go toward road construction, maintenance and repairs, meaning those who drive more pay more for the upkeep of highways, the foundation reported

---

Gas Tax Burdens by State (in Cents per Gallon)

Alerts Sign-up

Alerts Sign-up